How to Claim a Relative’s Abandoned Property

Any unclaimed property becomes property of the state. So what happens if a relative of yours dies and hasn’t written a will or kept any financial record of it?

May 10, 2024

Any unclaimed property becomes property of the state. So what happens if a relative of yours dies and hasn’t written a will or kept any financial record of it? If you do not make an effort to claim the property despite being the rightful person to inherit it, the property will likely be unknowingly forfeited. This article will provide an overview of how to claim a relative’s abandoned property.

Understanding Property Inheritance

The first step before claiming the abandoned property is to check whether you are a legal heir of the deceased relative’s property. This process may require in-depth research because you have to go through inheritance laws of the particular state where the property is located. If you are not familiar with the state’s inheritance laws, you can request legal consultation from a reputable real estate organization to confirm your inheritance and obtain possession of the desired property.

Claiming a Property

After determining that an abandoned property belongs to you, check whether the property has gone beyond the dormancy period. Generally defined as a 5-year timeframe in the United States, a dormancy period is the statutory time period between when a financial institution announces an asset as unclaimed and the state authorities deem that asset as abandoned. After this period, a property gains an escheatment status, which is the process of the government taking ownership of unclaimed properties and assets. Even if the government has taken ownership of a property, you can claim it by filing an application with the relevant state at a nominal fee. Keep in mind each state has its own process for claiming a property, which may be tedious but worth it to gain an asset! Once you file your claim, the state will initiate an investigation to confirm your claim and determine if you are the only claimant. Generally, state authorities require the following documents to submit a claim:

- Death certificate

- Statement of relationship or heir

- Prior tax return

- Stock certificate

- Gift return

This list is not complete but includes the most common documents requested by officials. Once the verification is complete, state jurisdiction will either deny the claim or accept it. If you are denied, you have the right to request the denial reasons. Often times the reason for denial can be a minor documentation issue so don’t give up! Once you have additional documentation you can always reapply for a claim. If your claim is accepted, you officially become the legal property owner. Once you obtain property rights, the asset is taxable. You will receive an IRS 1099 tax form from the state. If you would like assistance obtaining unclaimed property rights, consider free services from an organization called the National Association of Unclaimed Property Administrators (NAUPA). NAUPA’s mission is to return unclaimed property to its rightful owners and is a great resource for guiding you through the process. Whatever you do, don’t let a relative’s abandoned property end up on the Zombie list. Legally claim your entitled asset!

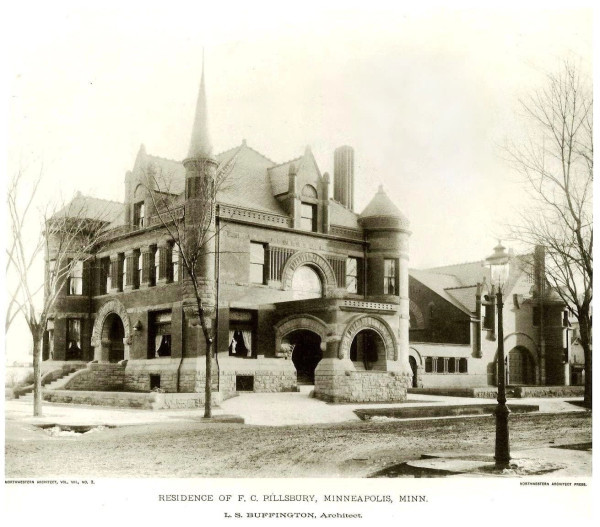

The Forgotten Pillsbury Mansion: The Rise and Fall of Frederick C. Pillsbury’s Lost Minneapolis Home

Once one of Minneapolis’s grandest residences, Frederick C. Pillsbury’s mansion didn’t survive the turn of the century. Here’s what happened.

Unlocking the secrets of your home's design and construction: A comprehensive guide to locating and utilizing your home's blueprints

Want to learn more about your home's design and construction? Here's everything you need to know about your home's blueprints to find out.

From Vacant to Abandoned, the Evolution of Decay

Routine maintenance is required to prevent any property from decaying. When no one is taking care of a property, time, and weather can quickly deteriorate its structural integrity and become a safety threat to the neighborhood.

The Marrian Moyer House: A Monument to Past Lives and Architectural Creativity

Join us for a tour of our Marrian Moyer House, a place where the past is still visible in the stained-glass windows and the exquisite woodwork. Learn about the occupants of this home and how they lived in this grand example of early 20th century architecture.