How to Prevent a Property from Becoming Abandoned

As a result of the United States housing foreclosure crisis from 2007-2010, the amount of foreclosed, abandoned, and unclaimed properties drastically increased, which can diminish the market value of surrounding properties.

May 10, 2024

As a result of the United States housing foreclosure crisis from 2007-2010, the amount of foreclosed, abandoned, and unclaimed properties drastically increased, which can diminish the market value of surrounding properties. ATTOM Data Solutions, the nation’s leading property database, discovered that as of 2020 there are approximately 1.5 million zombie buildings in America. Zombie buildings result from homeowners prematurely vacating their properties after receiving a foreclosure notice because they mistakenly assume their foreclosure lender is immediately responsible for the property, even if the lender does not complete the foreclosure process or sell the home. If you own a mortgaged property, this article will educate you on avoiding property abandonment.

Major Reasons for Property Abandonment

There are many reasons for property abandonment. Buildings are often deserted as a result of poor economic situations or demographics. Many experts suggest that the lack of employment in many regions is the reason why most individuals abandon their homes. If a community has high unemployment, there are minimal opportunities to sell or rent their home. For example, in the Midwest and Northeast region of the United States commonly referred to as Rustbelt, there has been a drastic economic decline since the 1980s as a result of unemployment causing a substantial increase in zombie buildings.

Another reason properties are left behind is that less than 2% of people are willing to close on a foreclosure property. To prevent a valuable property from becoming abandoned, check out the below resources:

Resources for Preventing Property Foreclosure and Abandonment

Free Online Budget Tools. For free online self-management financial budgeting and planning guidance, check out Mint. Mint offers you a holistic overview of your current budget, allows you to set financial goals, and sends you automated notifications. We also recommend downloading a free online password management tool called LastPass, so you can keep track of all of your financial account logins. Additionally, we encourage setting up all of your financial accounts on automatic payments to minimize forgotten payments and related late fees. Lastly, use bankrate.com to compare mortgage loans, personal loans, credit cards, car insurance, home insurance, and Certificate of Deposit (CD) rates at no cost.

Educate Yourself on Financial Opportunities. To learn about optimizing your personal finances, we recommend reading the book titled I Will Teach You to Be Rich by Ramit Sethi, which you can find on Amazon for less than $10. I also recommend getting a free annual credit report from annualcreditreport.com so you can monitor your credit score changes. It is important to continually educate yourself on your financial options to reduce the impact of economic downturns or personal loss.

Non-Profit Foreclosure Prevention Services. Many communities in the U.S. have local non-profits that provide free foreclosure prevention counseling and other property-related consulting. Most of these agencies are funded by HUD and NeighborWorks America. These organizations provide step-by-step guides for home buying, renting, defaults, foreclosures, and credit management. To avoid daunting Google searches, focus on finding government resources specific to the state where the mortgage loan was issued.

Read and Understand your Mortgage Loan Documents. Understanding your legal mortgage rights is incredibly important so you have a thorough understanding of mortgage foreclosure laws and time frames specific to your state.

Consult a Mortgage Lender. After following the above steps, a mortgage lender may provide additional insight and direction for financial obstacles. As soon as you realize you may be in a financial dilemma, consider talking to a lender that may provide financial options for avoiding foreclosure. Although people are often reluctant in seeking help until a problem is severe, this can be avoided through timely counseling.

Apart from the above-mentioned ways to avoid property abandonment and foreclosure, conscious budgeting and spending habits are key. Mindful living expenses can lead to financial independence and avoid losses.

The Marrian Moyer House: A Monument to Past Lives and Architectural Creativity

Join us for a tour of our Marrian Moyer House, a place where the past is still visible in the stained-glass windows and the exquisite woodwork. Learn about the occupants of this home and how they lived in this grand example of early 20th century architecture.

How to Renovate Abandoned Properties

During your life you have probably come across one or two abandoned properties you have considered buying or selling.

Top 5 Reasons Properties are Abandoned

Are you interested in history's mysteries? You can find abandoned properties all over the world when you know where to look.

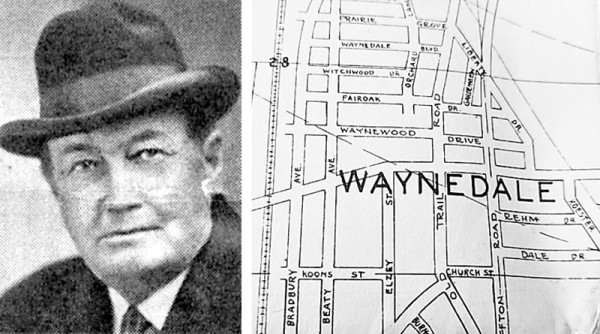

History of Waynedale Indiana

Explore and research the history of Waynedale Indiana