What's the different between a deed and title?

Unlocking Real Estate Jargon: Difference Between a Title and a Deed. In the complex world of property ownership, do you know the distinction between these two crucial terms?

August 23, 2023

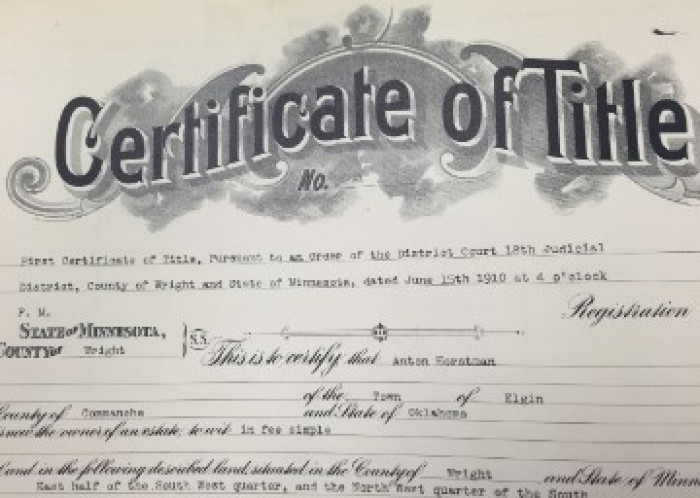

Historical Property Title, Wright County, MN

Title vs. Deed in Real Estate

In the realm of real estate, the terms "title" and "deed" often intertwine, creating confusion for many individuals, whether they're seasoned investors or first-time homebuyers. While both these terms pertain to property ownership, they represent distinct aspects of the real estate landscape. In this blog post, we're unraveling the difference between a title and a deed, shedding light on their roles, significance, and how they shape property transactions.

Key Differences between a Property Title and Deed

Nature and Function: The title is an abstract concept that represents ownership rights, while a deed is a concrete document that facilitates the transfer of those rights.

Scope: The title encompasses a wide range of ownership-related rights and interests, including the ability to use and convey the property. The deed, on the other hand, specifically addresses the act of transferring ownership from one party to another.

Longevity: The title remains with the property as long as the ownership remains intact. The deed, however, is often created and executed at the time of a property transaction, documenting the change in ownership.

Read on to dig a bit deeper into the two.

Understanding the Property Title

Imagine the title as a comprehensive umbrella that encompasses all the rights, interests, and claims associated with a property. When someone holds the title to a property, they essentially possess legal ownership and the bundle of rights that come with it. These rights might include the ability to occupy, use, lease, mortgage, and even transfer the property to others. In essence, the title signifies who has the legal right to the property and what they can do with it.

Components of a property title:

Property Owner: The title document identifies the individual, entity, or entities that legally own the property. This is the ultimate "who" of property ownership.

Legal Description: A precise and detailed description of the property's boundaries and location ensures there's no room for ambiguity. This description leaves no doubt about the specific piece of land or real estate being referred to.

Encumbrances and Liens: These are legal claims or restrictions on the property, which might include mortgages, liens, easements, or any agreements that impact the property's use or transfer.

Rights and Interests: The title outlines the rights and interests you hold as the property owner. These can include rights to occupy, use, lease, mortgage, or even sell the property.

Chain of Ownership: The title provides a historical account of how property ownership has changed hands over time, forming a chain of ownership that attests to its legitimacy.

There are several different types of property titles, each with its own implications for ownership and rights. Here are some of the common types of property titles:

Fee Simple Title: This is the most complete and comprehensive type of property title. It grants the owner full and unrestricted ownership rights to the property, including the right to use, occupy, lease, mortgage, and transfer the property. The owner has the highest level of control and can pass the property on to heirs or sell it without any limitations.

Leasehold Title: In a leasehold title, the owner holds the property for a specific period based on a lease agreement. While the owner has the right to use and enjoy the property during the lease term, ownership ultimately reverts to the landlord or lessor when the lease expires. This type of title is common in situations like renting an apartment or leasing land for a specific purpose.

Joint Tenancy Title: This type of title is often used for properties owned by multiple individuals, such as family members or business partners. Each owner holds an equal share of the property, and in the event of one owner's death, their share automatically passes to the surviving owner(s). This arrangement is characterized by the "right of survivorship," which ensures that the property doesn't go through probate upon the death of an owner.

Tenancy in Common Title: Similar to joint tenancy, tenancy in common is used for multiple owners, but each owner can hold unequal shares of the property. In this arrangement, there is no automatic transfer of ownership upon death, and each owner can freely transfer or sell their share without the consent of the others.

Community Property Title: This type of title is applicable in some U.S. states and is typically used for married couples. Any property acquired during the marriage is considered community property and is owned equally by both spouses, regardless of who earned the income to acquire the property. In the event of divorce or death, community property is often divided equally between the spouses.

Trustee Title: Properties held in trust have a trustee who holds legal title to the property on behalf of a beneficiary. Trusts are often used for estate planning or to manage assets on behalf of someone who may not be capable of managing them directly.

It's important to note that the terminology and specific legal implications of these titles can vary based on local laws and regulations. If you're considering purchasing property or have questions about a specific type of title, it's recommended to consult with a real estate attorney or a title company to ensure a clear understanding of your rights and responsibilities as a property owner.

Exploring the Property Deed

Contrastingly, a deed is a tangible legal document that serves as evidence of the transfer of ownership from one party to another. Think of a deed as the actual "key" that unlocks the ownership door. It's the formal written instrument that records and acknowledges the change in ownership status of a property. Deeds are often signed, witnessed, and notarized, making them legally binding documents that ensure the legitimacy of property transactions.

There are several different types of property deeds, each serving a specific purpose in conveying ownership and rights to a property. Here are some common types of property deeds:

Warranty Deed: A warranty deed is a type of deed that provides the highest level of protection for the buyer. The seller (grantor) guarantees that they hold clear title to the property and that there are no undisclosed liens or encumbrances. If any issues arise regarding the property's title, the seller is legally obligated to defend the buyer against these claims.

Quitclaim Deed: A quitclaim deed is a type of deed that transfers the grantor's interest in the property to the grantee (buyer) without making any warranties or guarantees about the title. It's often used in situations where property is transferred between family members, in divorce settlements, or to correct errors in a title. A quitclaim deed doesn't provide the same level of buyer protection as a warranty deed.

Special Warranty Deed: A special warranty deed is similar to a warranty deed, but the warranties provided by the seller are limited to the time they owned the property. This means that the seller guarantees that they have not caused any issues during their ownership, but they don't provide protection against issues that occurred before their ownership.

Grant Deed: A grant deed is similar to a warranty deed, but it typically includes fewer warranties. The seller guarantees that they haven't conveyed the property to anyone else and that there are no undisclosed encumbrances during their ownership. However, it doesn't offer as extensive protection as a warranty deed.

Bargain and Sale Deed: This type of deed implies that the seller holds the property and hasn't conveyed it to someone else. However, it doesn't include any warranties or guarantees about the title's quality or history.

Executor's Deed or Administrator's Deed: These deeds are used to transfer property from the estate of a deceased person to their heirs or beneficiaries. The executor or administrator of the estate acts as the grantor, conveying the property to the rightful parties.

Sheriff's Deed or Tax Deed: These deeds are often used in foreclosure or tax sale situations. A sheriff's deed is issued when a property is sold as part of a foreclosure sale, and a tax deed is issued when a property is sold due to unpaid property taxes. These types of deeds transfer the property to the winning bidder at the sale.

Trustee's Deed: This type of deed is used when property held in a trust is being transferred. The trustee, who holds legal title to the property, conveys the property to the grantee according to the terms of the trust.

It's important to consult with a real estate attorney or a qualified professional when selecting the appropriate type of deed for a property transaction, as the choice of deed can have legal and financial implications for both the buyer and the seller.

Navigating Property Transactions

In a real estate transaction, both the title and the deed play crucial roles. Before a property is sold, a title search is conducted to ensure that the title is "clear" – that is, free from any liens, encumbrances, or claims that could challenge the buyer's ownership. This process safeguards the buyer's interests and helps prevent any surprises after the transaction is completed.

Once the title is verified, the actual transfer of ownership is executed through the deed. This is where the seller formally conveys their ownership rights to the buyer. Different types of deeds, such as warranty deeds, quitclaim deeds, and special warranty deeds, offer varying levels of protection and warranties to the buyer.

Conclusion

In the intricate world of real estate, understanding the distinction between a title and a deed is essential. While the title represents the bundle of rights associated with property ownership, the deed is the concrete proof of a transfer of ownership. Together, these concepts form the foundation of property transactions, ensuring clarity, security, and legitimacy in the world of real estate. Whether you're entering the market as a buyer, seller, or enthusiast, grasping the difference between these two terms empowers you to navigate the complex realm of property ownership with confidence.

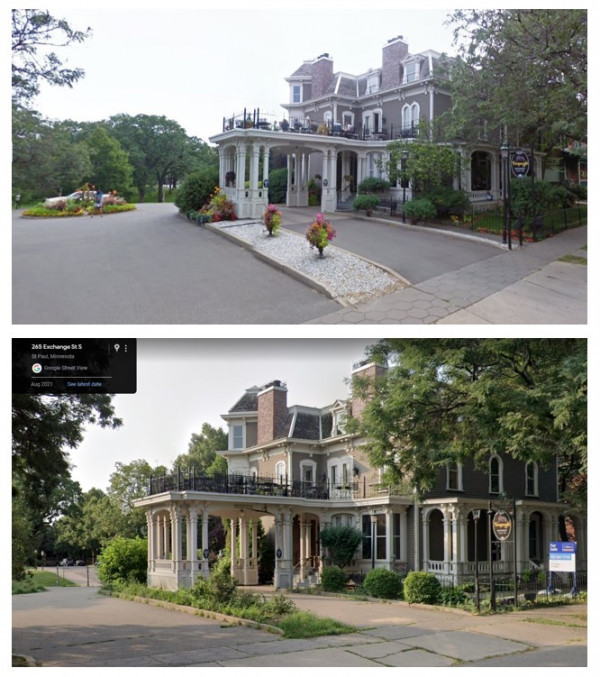

How to find my home’s history? A quick how-to guide to travel back in time with Google Street View

Time traveling with Google Maps is simple, here's how to do it.

5 Historic Cities Every Architecture Lover Should Visit

From Savannah to Santa Fe, these five cities are a dream for architecture and history lovers. Discover where to go, what to see, and how home history comes to life.

Comprehensive Guide to Architectural Styles: How to Identify Your Home’s Architecture

Not sure if your home is Tudor, Craftsman, or Mid-Century Modern? This comprehensive guide breaks down architectural styles with photos and defining characteristics to help you identify your home’s unique history.

House genealogy 101: Discovering home history through census records and property addresses

Utilizing census records and property addresses to learn more about your home's history.